U.S. Wireless Consolidation: A Historical Perspective for Today’s Telecom Analysts

Why Understanding This History Matters

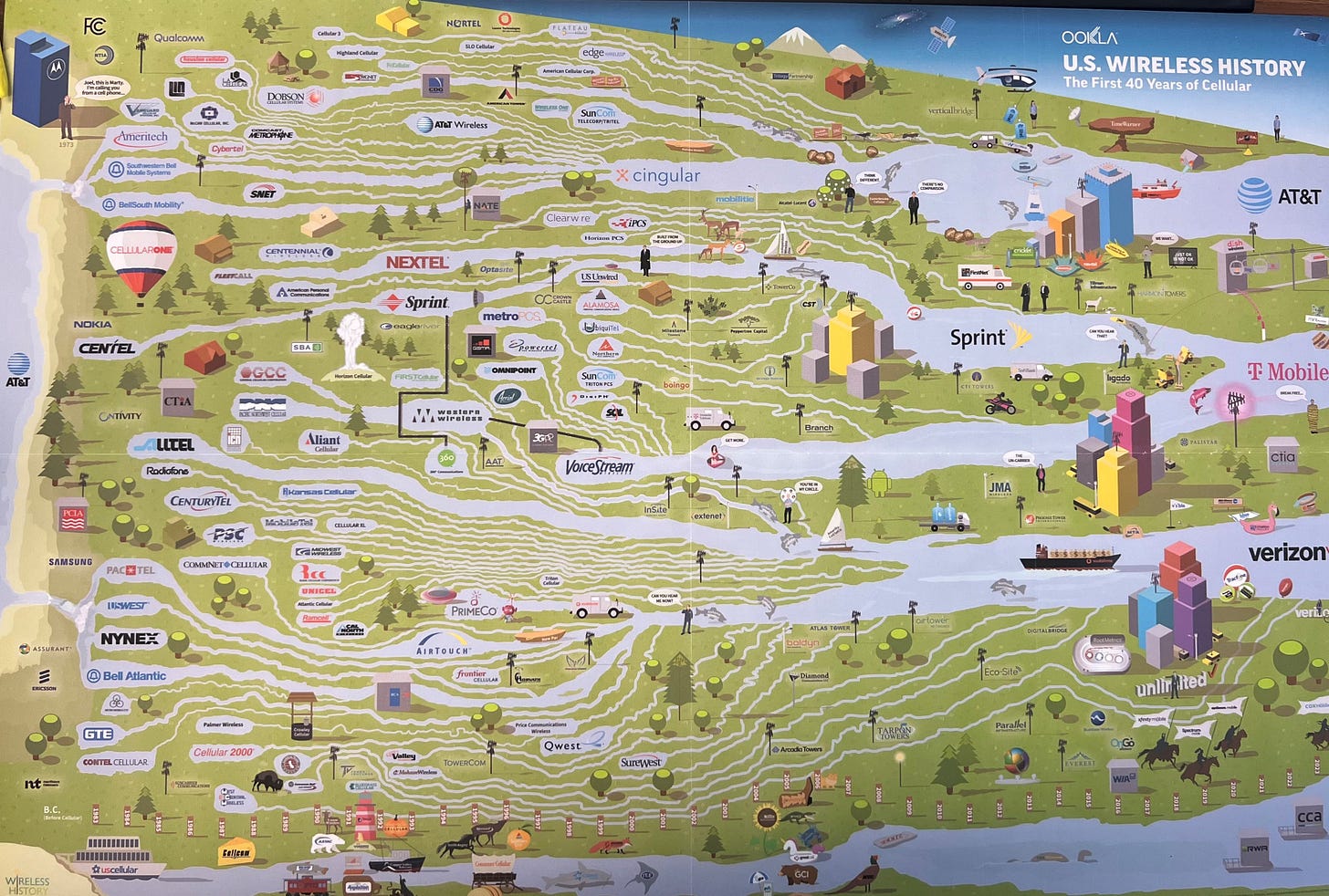

For today’s telecom analysts, it’s easy to view the U.S. wireless industry as a stable triopoly dominated by Verizon, AT&T, and T-Mobile, but this state of affairs is the result of decades of consolidation.

Unlike industries that developed around a few national players from the outset, U.S. wireless telecommunications began as a highly fragmented collection of regional carriers—many affiliated with Baby Bells or independent local telephone companies. This early structure, combined with regulatory shifts, technological evolution, and intense price competition, drove waves of mergers that transformed dozens of providers into today’s dominant carriers.

This report is designed for today’s generation of telecom analysts—those who may have deep expertise in 5G, spectrum allocation, and the latest network developments but lack firsthand knowledge of how the industry evolved to this stage. Understanding this history isn’t just academic; it helps explain ongoing structural challenges in the industry, including:

Why legacy IT and billing systems remain complex (due to years of acquisitions and system integrations).

Why Verizon, AT&T, and T-Mobile dominate spectrum holdings today (reflecting accumulated assets from decades of deals).

How competitive pressures changed from voice to data to AI-driven applications (and why certain pricing models persist).

Before diving into the timeline of mergers, it's important to first examine the pre-4G era, when voice revenue and roaming agreements played a central role in shaping wireless consolidation.

The Critical Role of Voice and Roaming Charges in Early Industry Consolidation

Before 4G and the dominance of mobile data, the wireless industry was driven by voice calls and roaming agreements. The structure of the market incentivized consolidation because of pricing models tied to geography.

1. Voice Revenue: The Primary Driver of Profitability

In the 2G and early 3G eras (1990s–2000s), wireless carriers made most of their money from voice minutes, not data.

Carriers competed aggressively on pricing plans based on voice minutes, often offering free nights and weekends or mobile-to-mobile calling to keep customers within their networks.

The move to unlimited calling plans (pioneered by companies like MetroPCS) helped accelerate consolidation by making scale a critical advantage.

2. Roaming Fees and Coverage Gaps Pushed Mergers

Regional carriers had limited coverage areas, meaning customers who traveled outside their home market incurred roaming fees.

This fragmented coverage structure encouraged consolidation, as larger carriers absorbed smaller ones to eliminate roaming costs and create national networks.

Roaming fees were a major consumer pain point, leading to mergers that could offer "one network, one price" nationwide coverage.

3. Technology Fragmentation and Spectrum Constraints

The industry was split between multiple network technologies:

CDMA (Verizon, Sprint, Alltel)

GSM (AT&T, T-Mobile, Cingular, VoiceStream)

iDEN (Nextel)

Customers on one network couldn’t use another carrier’s towers, forcing carriers to acquire companies with complementary footprints.

The shift to LTE as a unified global standard (post-2010) made these distinctions irrelevant but prior to 4G, technical incompatibility was a major driver of consolidation.

By the time 4G LTE became the dominant technology, consolidation had already created a handful of dominant national carriers—largely because roaming fees and voice revenue structures made regional networks unsustainable. As we examine the merger timeline, this pattern of consolidation becomes clear.

The Evolution of the U.S. Wireless Industry: From Many to Three

(See detailed timeline and merger history below.)

By the mid-2000s, the race to build nationwide networks led to a series of high-profile mergers. The most significant deals included:

Verizon’s formation in 2000 (Bell Atlantic + GTE + AirTouch) and later acquisition of Alltel (2009).

Cingular’s acquisition of AT&T Wireless (2004) and rebranding as AT&T Mobility (2007).

T-Mobile’s aggressive growth, from VoiceStream (2001) to MetroPCS (2013) to the Sprint merger (2020).

Each of these deals reduced the number of regional players and eliminated barriers to seamless nationwide coverage, setting the stage for the three major carriers we see today.

The Lingering Complexity of Legacy Systems from Mergers

Even though today’s networks are consolidated into three national players, the internal operations of these companies still bear the scars of past mergers. Many legacy IT and billing systems remain in place from acquired companies, making network management and backend operations far more complex than they appear externally.

Why Some Legacy Systems Still Exist

Billing Platforms: Many acquisitions involved integrating multiple incompatible billing systems. Some legacy platforms (from AT&T Wireless, Sprint, MetroPCS, etc.) still persist in customer support backends, even though consumers see a single brand.

Cell Site Infrastructure: Verizon, AT&T, and T-Mobile each inherited different legacy network architectures that required phased migrations over years. In some cases, older CDMA or GSM infrastructure is still maintained for backward compatibility.

Enterprise Accounts & Contracts: Many corporate and government clients still have contracts that date back to legacy carriers, meaning that billing, service agreements, and IT support often still reference defunct brands.

Why AI Will Require a Fundamentally New Architecture

While previous wireless industry shifts were driven by network coverage and consolidation, the AI-driven era introduces entirely new demands on telecom infrastructure. Unlike voice or even data services, AI applications require:

Massive distributed computing at the edge, reducing latency for AI inference.

Network slicing to dynamically allocate bandwidth for AI-driven applications.

Real-time data processing for autonomous systems, IoT, and next-gen applications.

The legacy architectures inherited from decades of mergers were not built for AI's low-latency, high-compute demands. This will require:

Cloud-native telecom stacks that integrate AI inference natively.

Deeper convergence of wireless and AI architectures beyond traditional data transport.

New spectrum strategies that prioritize AI-driven workloads over legacy mobile traffic.

The AI revolution will not simply optimize existing networks—it will require a fundamental rethinking of how wireless infrastructure is built and operated.

Conclusion: A Simplified Market, But Not a Simplified Industry

On the surface, the U.S. wireless industry appears simpler today than ever before—just three major carriers dominate the landscape. However, beneath the surface, the complexity from decades of mergers persists. The arrival of AI-driven telecom will only further challenge these legacy systems, forcing a new wave of innovation and transformation.